The EU Battery Regulation will come into effect on February 18, 2024. Against the backdrop of rapid global development in the new energy vehicle sector, battery cells for export face greater opportunities and challenges. What advanced carbon management experiences do battery cell companies have, and how should they meet the requirements of the Battery Regulation?

01

/Overview of the Battery Cell Industry/

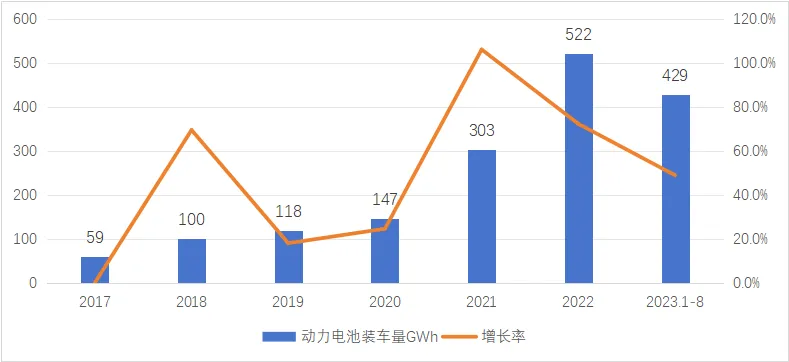

In recent years, the global battery cell market has seen robust growth. According to data published by global information agency SNE Research, global battery cell installations increased from 59 GWh in 2017 to 522 GWh in 2022, with an average annual compound growth rate of 54.6%.

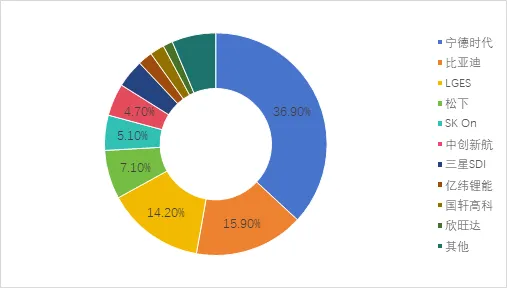

China is a significant production market for global battery cells. From January to August 2023, China's battery cell installations accounted for more than 60% of the global total, with CATL's battery cell installations accounting for 36.9% globally. Among the world's top ten battery cell manufacturers, six are Chinese companies.

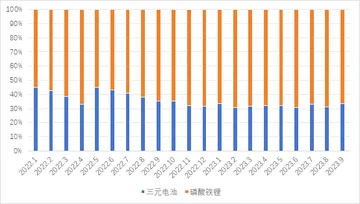

According to data released by the China Automotive Battery Industry Innovation Alliance, from January to September 2023, China's cumulative battery cell installations reached 255.7 GWh, with a year-on-year increase of 32.0%. By material type, ternary battery cumulative installations were 81.6 GWh, accounting for 31.9% of total installations, while lithium iron phosphate battery cumulative installations were 173.8 GWh, accounting for 68.0% of total installations. In recent years, with the reduction of subsidies for new energy vehicles, lithium iron phosphate batteries have gained popularity due to cost advantages and improved energy density, surpassing ternary batteries in installation volume in 2021. From January to September 2023, lithium iron phosphate batteries accounted for nearly 70% of total installations.

Battery cells are the power source of electric vehicles and serve as energy storage devices. Based on the source of energy, battery cells can be classified into chemical batteries, physical batteries, and biological batteries. Among these, lithium-ion batteries are widely used in pure electric vehicles due to their high operating voltage, large energy density, long cycle life, and lack of heavy metal pollution.

Lithium-ion batteries are a common type of secondary battery. Their working principle involves the movement of lithium ions between the positive and negative electrodes to achieve charging and discharging. Lithium-ion batteries mainly consist of the cathode, anode, separator, and electrolyte.

The cathode material is the sole supplier of lithium ions in lithium-ion batteries and plays a decisive role in improving the energy density and reducing the cost of lithium-ion batteries. The anode material affects the safety of lithium-ion batteries, and currently, carbon-based anode materials such as carbon fibers, synthetic graphite, and natural graphite are widely used. The separator primarily isolates the positive and negative electrodes to prevent short circuits and self-discharge while providing a good ion channel between the two electrodes. The separator is typically made of porous polyolefin films such as polyethylene (PE) and polypropylene (PP), especially PP/PE/PP three-layer composite separators. The electrolyte mainly includes high-purity organic solvents and lithium salt electrolytes (lithium hexafluorophosphate).

Based on different cathode materials, lithium-ion batteries are mainly divided into lithium iron phosphate (LFP) batteries, manganese oxide lithium batteries, lithium cobalt oxide (LCO) batteries, lithium nickel oxide (LNO) batteries, and various ternary lithium batteries. By battery shape, lithium-ion batteries can be categorized into prismatic lithium-ion batteries and cylindrical lithium-ion batteries.

_1728640661539717.webp)

The battery cell industry chain is relatively long and covers a wide range of sectors.

The upstream of the battery cell industry chain involves the production of raw materials such as cathode materials, anode materials, electrolytes, separators, solid electrolytes, structural components, and nickel hydroxide. For cathode materials, the raw materials for NCM ternary cathode materials include nickel concentrate, copper-nickel ore by-products, manganese ore, and spodumene. The raw materials for lithium iron phosphate cathode materials include phosphate ore, iron ore, and spodumene. For anode materials, the main anode material for battery cells is artificial graphite, and the upstream of the artificial graphite anode material industry mainly consists of basic chemical industries such as petroleum and coal.

The midstream of the battery cell industry chain includes lithium-ion battery manufacturers, mainly engaged in cell manufacturing and packaging. Battery cells can be divided into three levels: cells/cells (Cell), modules (Module), and battery packs/battery systems (Pack). The cell production process mainly involves processing various raw materials into semi-finished cells and then activating the cells through charge-discharge processes. The module production process mainly includes sub-module production processes and the assembly of sub-modules into modules. The battery pack PACK production process mainly involves assembling modules, lower shell assemblies, liquid cooling systems, electrical systems, battery management systems, and upper shell assemblies into battery packs.

The downstream of the battery cell industry includes electric passenger vehicles and commercial electric vehicles, generally consisting of a series of components and system assemblies such as motors, batteries, chassis, and automotive electronics. In the four key technologies of new energy vehicles, most of the electric control technology is handled by vehicle manufacturers.

Taking a typical lithium-ion battery as an example, according to the weight of the raw materials, the material composition of lithium-ion batteries with different cathode materials is shown in the following table.

_1728640712991802.webp)

02

/Carbon Reduction Practices of Domestic and Foreign Battery Cell Companies/

As a core component of new energy vehicles, battery cells account for up to 40% of the total carbon emissions over the lifecycle of electric vehicles. In this context, domestic and foreign battery cell companies have continuously implemented carbon reduction practices, enhancing carbon management and compliance with export regulations. According to observations by Carbonstop, the main carbon reduction measures taken by battery cell companies include:

Product Carbon Footprint Disclosure and Standard Construction: Zhongchuang Xinhang conducted carbon footprint calculations for smart #1 battery cells based on EU PEFCR and ISO 14067 standards, obtaining the first EU carbon footprint certificate in China; CATL's 280Ah LFP cell received the first Environmental Product Declaration (EPD) in the global battery cell industry; Farasis Energy collaborated with the China Electronic Energy Saving Technology Association to develop the first lithium-ion battery product carbon footprint evaluation standard in China. Internationally, LGES partnered with the Global Battery Alliance (GBA) and the European Lithium-Ion Battery Association to develop battery product carbon footprint calculation standards and obtained carbon footprint certifications for several products; Samsung SDI has also obtained carbon labels for cells and modules based on PAS 2050 and PEFCR evaluations.

Organizational Carbon Inventory and Emission Reductions: CATL has published carbon emission inventory reports for two consecutive years, setting targets to achieve carbon neutrality in core operations by 2025 and across the entire value chain by 2035, and has established four zero-carbon factories including Sichuan CATL; Guoxuan High-Tech has built a 2 GWh photovoltaic power generation facility to support its 400,000-ton negative electrode material project in Wuhai, creating a zero-carbon base for new energy battery materials; Farasis Energy, based on ISO 14064 certification, has implemented reduction measures through purchasing international green certificates, distributed photovoltaics, self-built energy storage stations, and waste recycling, and achieved carbon neutrality in the production of products supplied to Mercedes-Benz by purchasing Verified Emission Reductions (VER).

Supplier Management and Supply Chain Traceability: CATL was the first to use blockchain technology for raw material traceability and initiated the "CREDIT" value chain sustainability transparency audit program, placing "C" for carbon footprint at the forefront and incorporating issues such as climate change response, energy management, and sustainable procurement management into supplier audits. LGES requires primary suppliers to use 100% green electricity by 2025 and plans to gradually extend this requirement to deeper-level suppliers. Upstream industries in the battery cell supply chain are also actively adapting to the needs of battery cell companies. For example, the lithium carbonate industry has reduced the carbon footprint of battery raw materials through innovations in electrochemical intercalation, efficient membrane separation, and clean energy projects such as solar power and hydrogen production from brine.

Secondary Use and Recycling of Retired Batteries: BAK Battery has jointly built a secondary use energy storage station with China Southern Power Grid, and CALB has applied retired batteries for secondary use in China Tower's communication base stations. BYD has also collaborated with China Tower to promote the large-scale utilization of retired batteries. In the recycling phase, BYD has developed a three-step strategy involving detailed disassembly, material recovery, and reactivation, completing the industry chain loop with its own capacity and third-party partners. Huayou Cobalt and BMW Group have developed a "waste-for-materials" recycling model, achieving closed-loop recycling management of battery cell raw materials, reducing carbon emissions by 40% in secondary use and by 30% in regeneration.

03

/Four Approaches for Battery Cell Companies to Meet the Battery Regulation/

The new battery regulation sets fourteen requirements for different types of batteries, twelve of which apply specifically to battery cells, including:

- Carbon Footprint Requirements: Specific process flows for battery carbon footprint calculations must be defined, considering the battery model, and the carbon footprint must be calculated and reported in stages. The carbon footprint level must be indicated, and it must be proven in the accompanying technical documentation that the carbon footprint over the battery's lifecycle is below the threshold set by the regulation.

- Waste Management: Specifies collection rates, recycling efficiency, and material recovery levels for spent batteries, extending producers' responsibilities for battery waste collection, treatment, and reporting. To ensure traceability and upstream participant involvement, companies must ensure supply chain due diligence.

- Information Disclosure: Disclosure content includes the above basic information, capacity, recycled materials, etc. Disclosure formats include labels, CE marks, and "battery passports," with specific information required for each format.

From the above requirements, it is clear that companies can take the following four approaches to better meet the new battery regulation:

Comply with Regulations for Carbon Footprint Calculation and Practice Lifecycle Emission Reductions

In accordance with PEFCR requirements, companies need to collect and calculate carbon emission data from upstream raw material processing and pretreatment, battery production, recycling, and utilization, and disclose this information. To remain below the carbon footprint threshold set by the regulation, companies should focus on full lifecycle carbon reduction management in terms of raw materials, energy usage, and new technology development.

Actively Develop Recycling Business and Strengthen Supply Chain Management

Establish compliance management in the supply chain, strengthen cooperation with supply chain partners, ensure supply chain transparency and traceability, and actively promote energy savings and emission reductions among upstream suppliers. Companies can also develop recycling businesses through self-built recycling bases or partnerships with third parties, promoting secondary use or recycling of retired batteries.

Strengthen External Communication and Improve Information Disclosure

On one hand, companies should disclose mandatory data attributes and voluntary recommendations as required by the battery passport and other forms. They can also actively disclose their carbon management and reduction achievements to society through ESG reports, low-carbon development white papers, and product carbon footprint certificates, showcasing their competitive advantages and providing good examples for the industry's low-carbon development and export compliance.

Enhance Industrial Carbon Data Collection

The battery regulation has strict requirements for the collection of carbon footprint-related data. By using system platforms, companies can not only address the issue of disorganized and unfocused carbon data but also reduce the costs associated with carbon footprint data compliance reporting and external disclosure. Additionally, this approach can build a solid foundation for data management capabilities needed for other disclosure and reporting requirements beyond the battery regulation. Carbonstop has extensive customer case studies and industry knowledge, capable of providing one-stop solutions for industrial enterprises in terms of establishing carbon data management systems, building carbon data collection capabilities, and constructing carbon data analysis platforms.