Background Review

On April 19, 2024, the Hong Kong Exchanges and Clearing Limited (hereinafter referred to as "HKEX") issued the Consultation Conclusions Document (hereinafter referred to as The Consultation Summary) on optimizing climate-related disclosure under the Environmental, Social, and Governance (ESG) framework. It comes with an Implementation Guide to assist HKEX issuers in understanding the new climate-related disclosure requirements (hereinafter referred to as "New Climate Rules") under Part D of the ESG Reporting Guide.

This revision is the longest ESG guidance revision process initiated by the HKEX. On April 14, 2023, after a comprehensive review of its ESG framework, the HKEX launched a draft of the New Climate Rules and published the Consultation Paper, aiming to prepare issuers for the climate-related disclosure requirements based on the ISSB climate standards. The consultation period ended on July 14, 2023.

During the consultation period, the HKEX received 115 responses from a wide range of sectors, with the draft of the new climate rules gaining support from most respondents. The HKEX ultimately adopted all proposals with some modifications, aligning closely with the International Financial Reporting Standard S2 - Climate-related Disclosures (IFRS S2).

The release of the New Climate Rules marks a new phase in ESG regulation in the Hong Kong stock market.This article will outline the key revisions of the final New Climate Rules compared to the draft, analyze the similarities and differences with the disclosure guidelines for sustainable development reports on the A-share market, and further deepen the understanding of the content of the New Climate Rules.

Key Points of the New Regulations at a Glance

Overall, the New Climate Rules are formulated based on IFRS S2 and provide implementation exemptions, including proportional and phased expansion measures, to address the challenges some issuers may face in reporting.

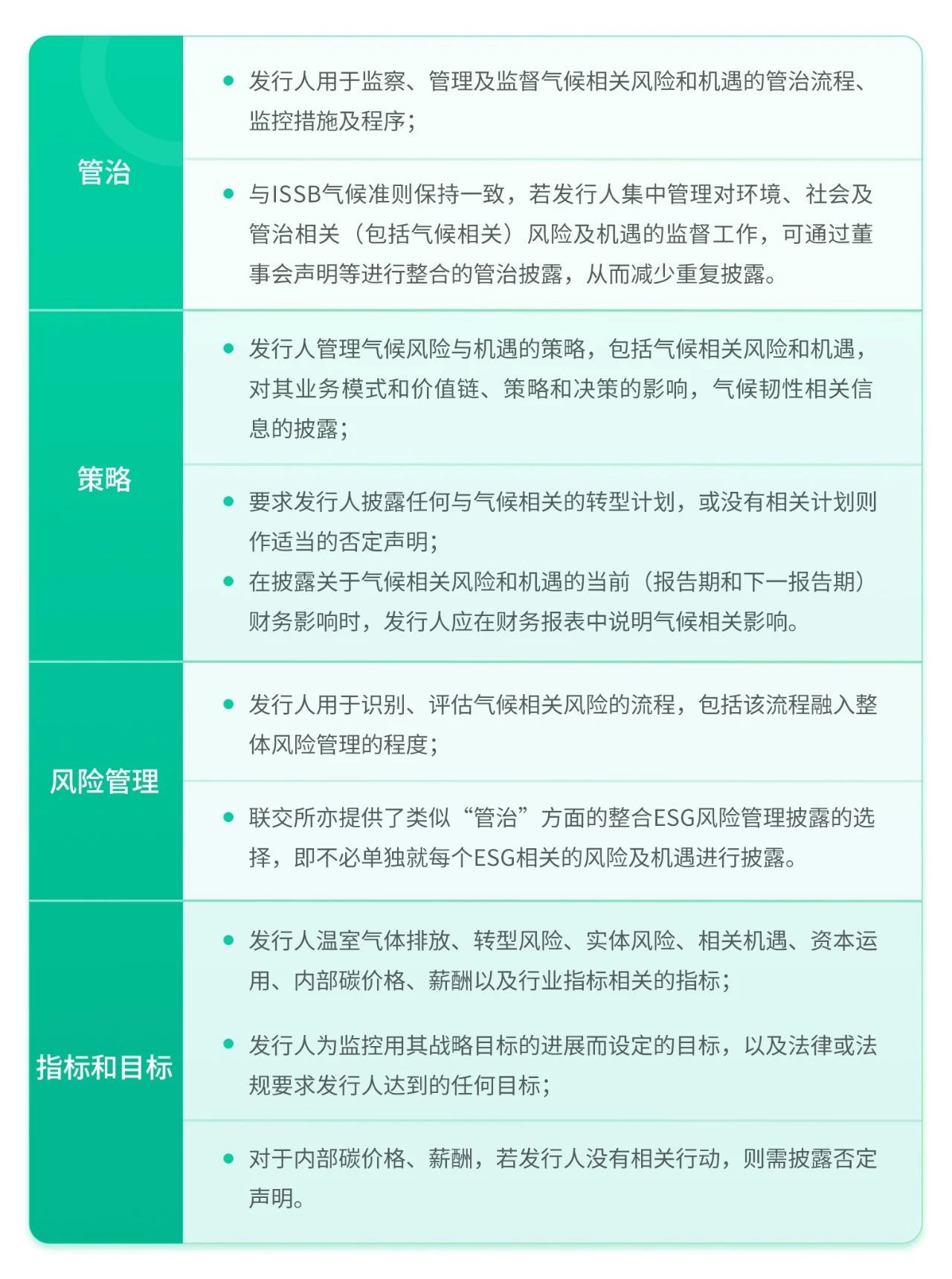

Key Point 1: Core Content of Four Pillars

Compared to the Consultation Paper, there has been little change in the new climate regulations, which refer to the four core pillars recommended by TCFD—Governance, Strategy, Risk Management, and Metrics and Targets—and are more closely aligned with IFRS S2. The table below summarizes the main content of the new rules:

Key Point 2: Phased Approach to Promote Climate Disclosure

Considering the ISSB Implementation Guidance Overview and market opinions, the HKEX plans to adopt a phased approach to require issuers to report according to the new climate regulations. The table below outlines the disclosure responsibilities and effective dates of the new climate regulations:

*According to the ESG Code, issuers that have been constituents of the Hang Seng Composite LargeCap Index (https://www.hsi.com.hk/chi/indexes/all-indexes/sizeindexes) throughout the year preceding the reporting year shall be required to make mandatory disclosures starting from 2026. Therefore, issuers that were constituents of the Hang Seng Composite LargeCap Index throughout the 2025 fiscal year must comply with mandatory climate reporting in their ESG reports for the 2026 fiscal year, which will be published in 2027.

(a) For fiscal years starting on or after January 1, 2025, all listed issuers (i.e., Main Board listed issuers and GEM listed issuers) are mandatorily required to disclose Scope 1 and Scope 2 greenhouse gas emissions;

(b) For fiscal years starting on or after January 1, 2025, in addition to the mandatory disclosure of Scope 1 and Scope 2 greenhouse gas emissions (required for all issuers), all Main Board listed issuers shall report on the new climate regulations on a “comply or explain” basis;

(c) For fiscal years starting on or after January 1, 2026, large-cap issuers (i.e., issuers that are constituents of the Hang Seng Composite LargeCap Index) are mandatorily required to report on the new climate regulations in their ESG reports;

(d) For fiscal years starting on or after January 1, 2025, in addition to the mandatory disclosure of Scope 1 and Scope 2 greenhouse gas emissions (required for all issuers), GEM listed issuers are encouraged to voluntarily report on the new climate regulations.

As of December 31, 2023, the total market capitalization of Hang Seng Composite LargeCap Index constituents accounted for 74.24% of the total market capitalization of all listed issuers.By adopting a phased approach, larger issuers with available resources can lead the way in mandatory climate reporting, providing motivation for other companies.

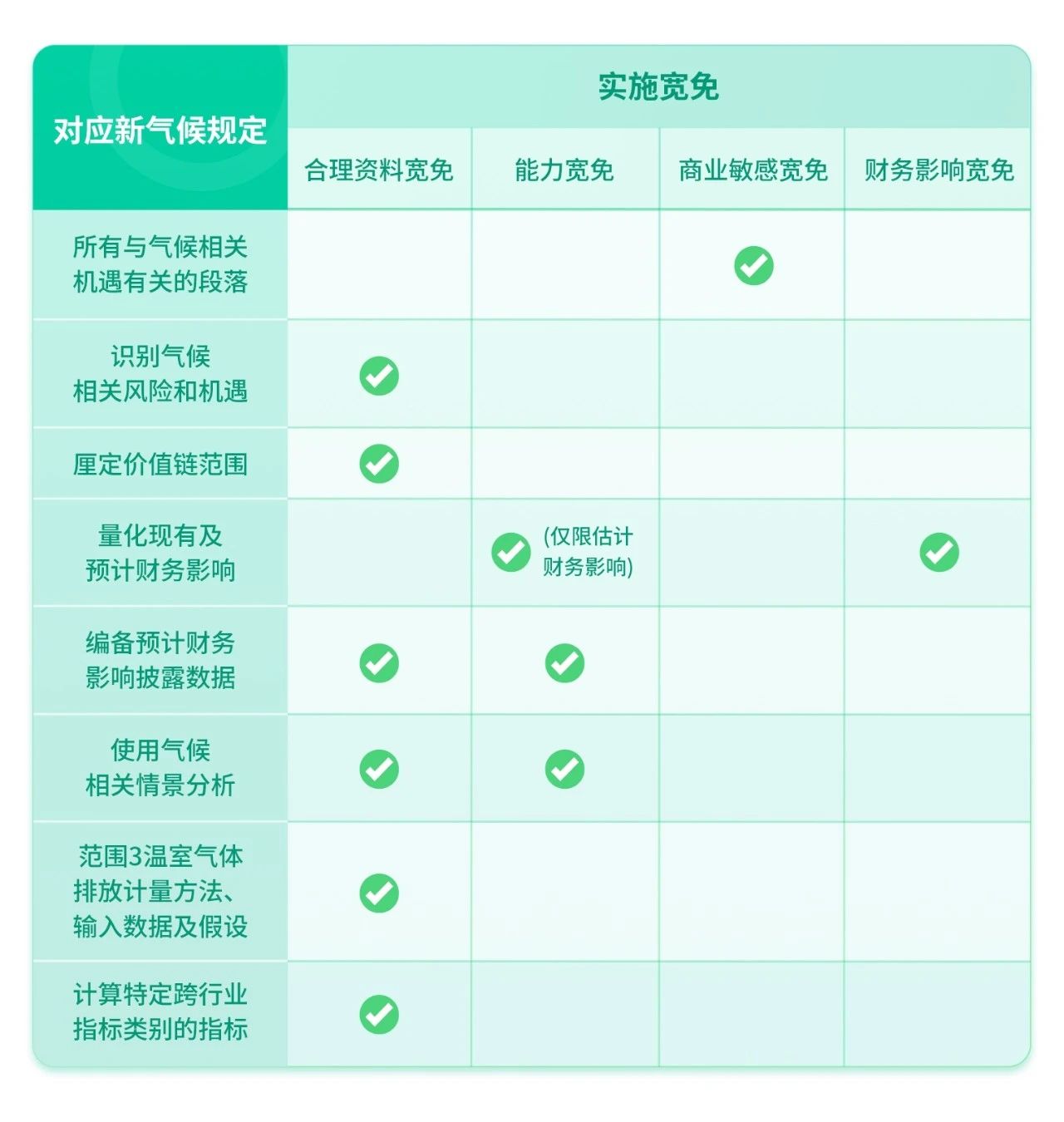

Key Point 3: Provision of Exemption Policies

The HKEX's New Climate Rules comprehensively introduce the requirements of the ISSB climate standards but consider that some issuers may face challenges in reporting due to insufficient resources, technical knowledge, and professional capabilities. The ESG Code provides implementation exemptions for different scenarios.

The HKEX also explains the meanings of the four categories of exemptions:

- Reasonable Data Exemption: All reasonable and substantiated information that can be obtained without undue cost or effort on the reporting date. Whether the cost or effort is undue depends on the issuer’s circumstances; reasonable and substantiated information can include external information (such as ESG ratings from rating agencies, sustainability disclosures, and economists' forecasts) and internal information (such as the issuer’s risk management responses and climate risk assessments);

- Capacity Exemption: Allows issuers to conduct climate-related scenario analysis and expected financial impacts based on their existing skills, abilities, and resources;

- Commercially Sensitive Exemption: Information that issuers deem commercially sensitive can be exempted from the disclosure requirements related to climate-related opportunities, but they must state that the information has used this exemption;

- Financial Impact Exemption: When the current or expected financial impact of climate-related risks and opportunities cannot be separately identified, issuers can substitute quantitative financial data with qualitative information.

Exemption measures can effectively reduce the compliance pressure on issuers to disclose climate-related information, but the purpose of the new rules is to mandate listed issuers to disclose climate-related information in their ESG reports according to the ISSB climate standards (i.e., to elevate the current "comply or explain" requirement), and the above exemption measures also need to meet specific prerequisites to be used. If an issuer uses an exemption clause, they must also disclose their subsequent work plans, progress, and timelines.

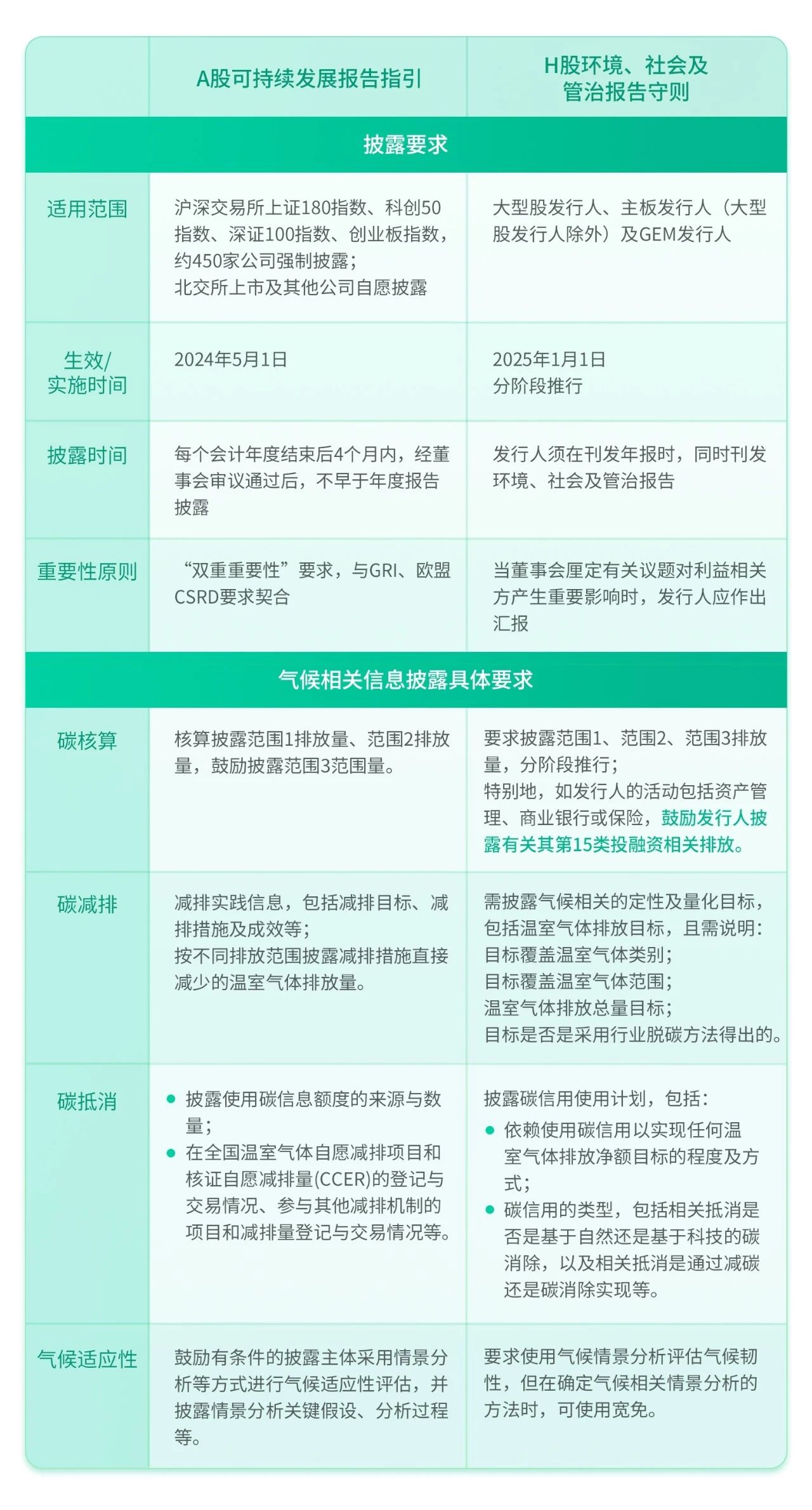

Comparison with Disclosure Requirements of the A-share Sustainable Development Report Guidelines

Currently, both the A-share and H-share markets are entering a new phase of ESG regulation. For an introduction to the new guidelines for A-shares, see Focus | Understanding the A-share Sustainable Development Report Guidelines. This section analyzes and compares the requirements for disclosure work and the important requirements for climate-related disclosures:

Summary of New Regulatory Requirements

The signal from the HKEX regarding stricter requirements for climate-related disclosures is clearer, while also providing sufficient preparation time for listed companies in Hong Kong to respond to the new rules. The HKEX's New Climate Rules serve as transitional measures before the adoption of Hong Kong standards. According to the Hong Kong roadmap, the Hong Kong Institute of Certified Public Accountants, as the standard setter for Hong Kong’s sustainable reporting standards, will be responsible for developing the Hong Kong standards. After the establishment of the Hong Kong standards, the HKEX will consider whether and how to transition to sustainable reporting based on the Hong Kong standards. In the Consultation Conclusions, the HKEX also mentions the possibility of mandating all listed issuers to make climate-related disclosures under future Hong Kong standards. Currently, the HKEX is adopting a "step-by-step" approach to implement the new climate regulations, giving listed companies in Hong Kong more time to prepare the relevant materials.

Listed companies in Hong Kong are advised to actively respond, familiarize themselves with the detailed disclosure requirements and key deadlines, and start preparing management efforts in advance. In the 2024 and 2025 ESG reports, the requirements should be implemented in phases to fully prepare for the full implementation of the new climate disclosure regulations.

The new regulatory requirements impose higher demands on companies' comprehensive and systematic carbon management and climate risk management work. Compared with the new guidelines for A-shares, the HKEX's New Climate Rules are more closely aligned with the ISSB climate standards, specifying detailed disclosure requirements for climate-related information. For example, when disclosing greenhouse gas accounting, issuers should explain the measurement methods, inputs, and assumptions used in calculating greenhouse gas emissions, as well as any changes made to these methods, input data, and assumptions during the reporting period and the reasons for such changes. Therefore, listed companies need to establish a sound carbon management system, fully and accurately grasp their own carbon emissions and those of upstream and downstream supply chains, standardize the management of corporate carbon emission data, and implement carbon emission targets and pathways to effectively support the company's ESG disclosure requirements.

At the same time, the new rules also propose that listed companies should actively promote climate scenario analysis to achieve quantification of the impact and opportunities of climate change on business operations; and disclose current and expected climate-related financial impacts, etc. However, the relevant climate analysis databases and quantification models are not yet mature, making the analysis challenging. Listed companies can pay attention in advance, first emphasizing climate risk regulation at the board level, actively formulating climate risk and opportunity response strategies related to the company itself, and gradually establishing a framework for the quantification of climate risks, systematic conduct of climate risk management, identification of climate opportunities, and climate information disclosure work.Moreover, participating in international initiatives such as Carbon Disclosure Project (CDP) and the Science Based Targets initiative (SBTi), and obtaining good ratings within these organizations, are also necessary means to help companies improve their carbon management and climate risk management.