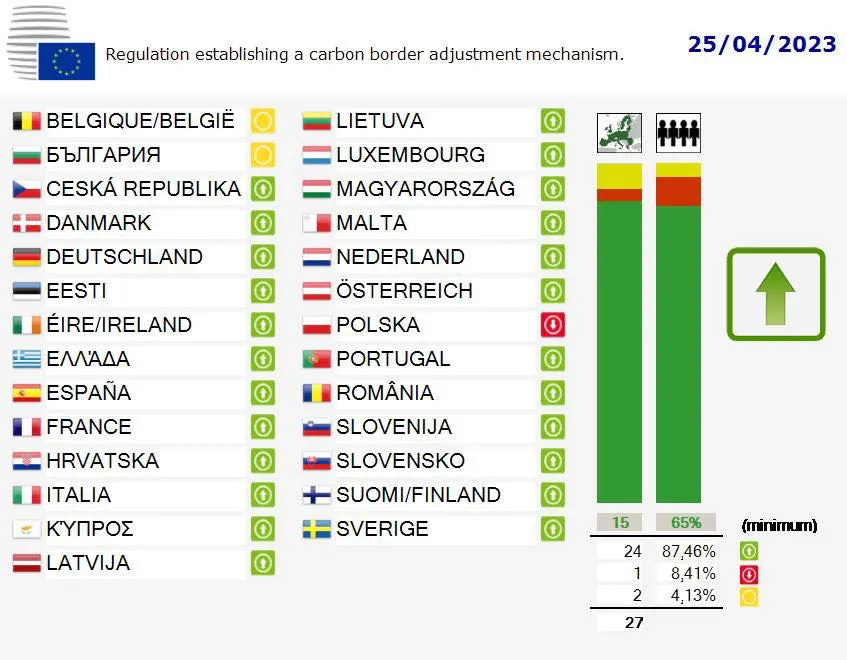

On April 25, the Council of the European Union voted to adopt the EU Carbon Border Adjustment Mechanism (CBAM), marking the completion of the legislative process for the EU carbon tariff, which is now officially adopted.

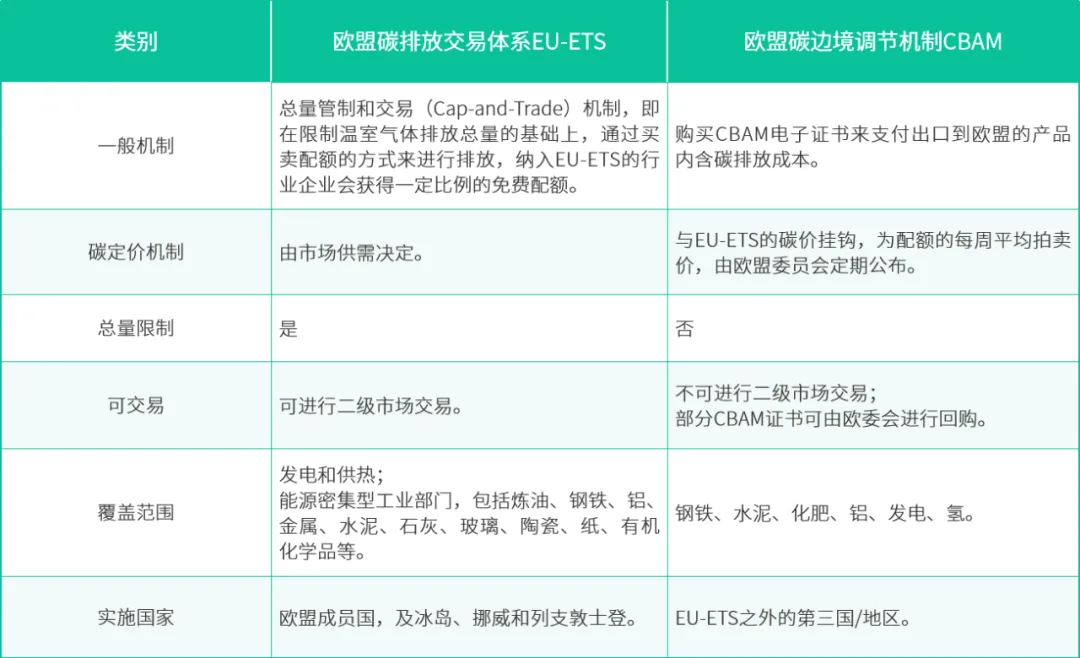

The EU carbon tariff is part of the EU's package of decarbonization policies (Fit for 55) aimed at achieving the 2030 European climate targets. Alongside the EU carbon tariff, the Council also adopted four other policies from the Fit for 55 decarbonization policy toolkit, including updates to the EU Emissions Trading System (ETS), the inclusion of maritime emissions in the EU ETS, the establishment of an emissions trading system for buildings and road transport, and aviation emissions.

This article aims to introduce the latest developments in the EU carbon tariff and discuss how Chinese exporting manufacturers can strengthen their organizational and product-level carbon management capabilities during the transition window period to better cope with the impact of the EU carbon tariff on their businesses.

01

Settled

/ The EU Carbon Tariff Officially Takes Effect /

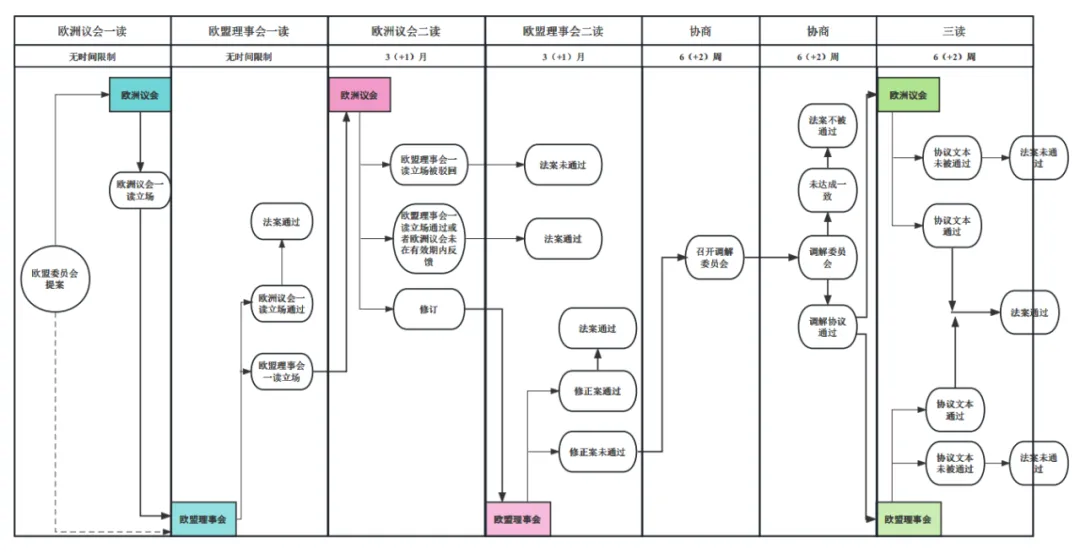

Since the European Commission first submitted the legislative proposal for the EU carbon tariff in July 2021, CBAM has received significant attention and has been "adopted" multiple times in various institutions. Why is it being referred to as "officially adopted" this time? We need to understand the EU legislative process.

The EU legislative process generally involves three bodies: the European Commission (EC) is responsible for submitting legislative proposals, while the European Parliament (EP) and the Council of the European Union (Council) are responsible for reviewing, amending, and adopting the proposals.

In brief, after the EC submits a legislative proposal, the EP and the Council separately review the proposal and make decisions to adopt, amend, or reject it.

Once the legislative proposal is adopted by both the EP and the Council, the legislative process is considered complete. The next step is publication in the Official Journal of the European Union (OJEU), after which it becomes effective.

Since July 2021, although the legislative process for the EU carbon tariff has had some twists (such as the dramatic cancellation of the EP vote on CBAM in June 2022) and debates over different positions (e.g., discussions on the scope of CBAM between the EP and the Council), CBAM was officially adopted on April 25, 2023, marking a new phase in EU climate action.

02

What Does CBAM Cover?

/ How Is Carbon Emission Calculated? /

The introduction of the EU carbon tariff is aimed at addressing the issue of carbon leakage, which refers to the situation where companies move production to countries with less stringent emission restrictions due to the costs associated with climate policies.

The EU has set ambitious climate targets and established the world's first and largest emissions trading system (EU ETS). Domestic producers, especially those in energy-intensive industries, need to pay for the carbon emissions from their production activities, which puts their products at a price disadvantage compared to imports. The EU carbon tariff is designed to address this issue.

2.1 Coverage Scope

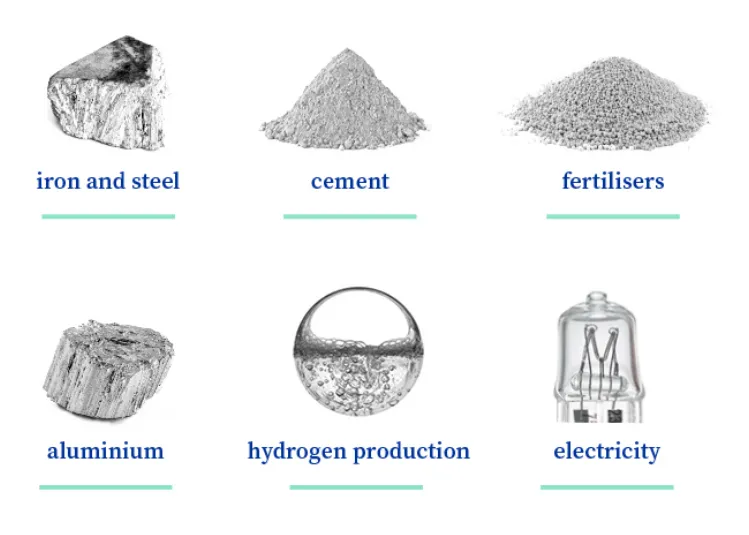

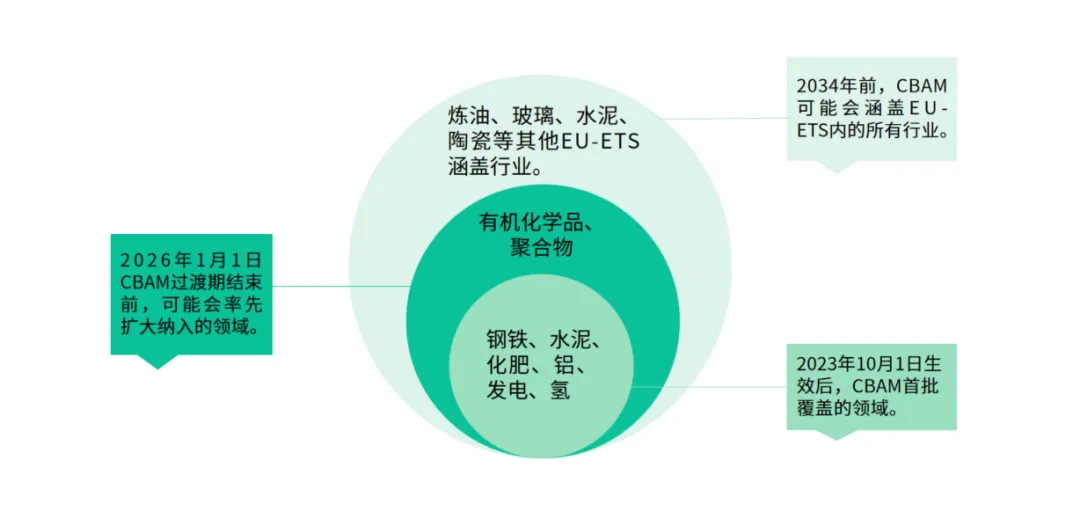

The EU carbon tariff covers iron and steel, cement, fertilizers, aluminum, hydrogen production, electricity generation, and certain precursors (input materials) and downstream products, such as screws and bolts and similar iron or steel products. Indirect emissions may also be included under certain circumstances. Since there is no power trade between China and Europe, the main affected categories are the first few mentioned.

2.2 Implementation Period

From October 1, 2023, to the end of 2025, it is the transition period. During this period, companies are only required to fulfill reporting obligations and do not need to pay the carbon tariff. After the transition period, free allowances for CBAM-covered sectors will be phased out gradually from 2026 to 2034.

2.3 Operating Mechanism

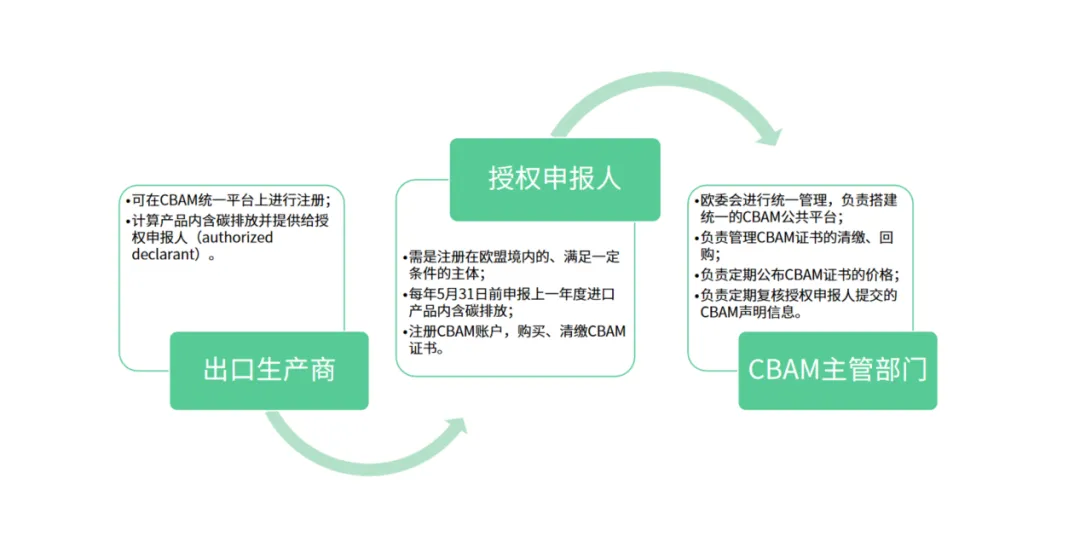

The European Commission will establish a public platform for CBAM electronic certificate management. Authorized declarants (i.e., customs declarants) who meet certain conditions and are established in the EU will have the right to import goods listed under the CBAM regulation, submit CBAM declarations, and purchase CBAM certificates.

Exporters must annually submit information on the total quantity of imported goods and the carbon emissions of the previous year to the authorized declarant. The CBAM declaration information to be submitted by the authorized declarant must be verified by a verification body and reported by May 31 each year.

CBAM certificates cannot be traded on the secondary market but can be partially repurchased by the European Commission on the public platform.

2.4 CBAM Price

The price of CBAM certificates is based on the average closing price of the EU Emissions Trading System (EU-ETS) for each calendar week.

2.5 Calculation of Carbon Emissions

CBAM requires the reporting of embedded emissions for covered imported products, which include direct emissions from the production process, such as heating and cooling emissions (Scope 1), and indirect emissions from electricity consumption (Scope 2). For steel, aluminum, and hydrogen, only direct emissions are initially considered, while for cement and fertilizers, both direct and indirect emissions are included.

CBAM-covered products are divided into simple goods and complex goods.

Simple goods are those produced using raw materials and fuels with zero embedded emissions, i.e., directly processed from natural materials. The embedded carbon emissions of simple goods need to account for direct emissions from the production process and, under certain conditions, indirect emissions from electricity consumption during production.

Complex goods refer to products that require simple goods to be used in their production process, meaning they are manufactured using simple goods. In addition to calculating direct emissions from the production process and indirect emissions from electricity consumption under certain conditions, complex goods must also consider the embedded carbon emissions of certain precursors (precursors).

Currently, the detailed implementation rules for the calculation of embedded carbon emissions under CBAM have not been released, and the specific boundary selection still needs to be refined. The European Commission will publish the detailed implementation rules of CBAM by June 30, 2025, clarifying the choice of system boundaries, the precursor materials included, and emission factors.

03

Which Enterprises

/ Will Be Affected? /

As previously mentioned, CBAM was introduced to address the issue of carbon leakage within the EU, serving as a complementary mechanism to the EU Emissions Trading System (EU-ETS). Domestic producers in energy-intensive industries in the EU need to bear the cost of carbon emissions. To prevent high-emission industries from relocating to countries with lower climate targets and to ensure the competitiveness of EU domestic producers, a so-called "carbon tariff" is levied on high-emission products from third countries.

With the implementation of CBAM and the confirmation of the EU-ETS reform plan, CBAM will be implemented in tandem with the phasing out of free allowances in the EU-ETS, ultimately eliminating all free allowances in the EU-ETS by 2034. This means that, as a mechanism running parallel to the EU-ETS, CBAM could potentially cover all industries within the EU-ETS by 2034.

In addition, during the CBAM legislative process, the European Parliament proposed expanding the coverage of the CBAM transition period to include organic chemicals and polymers. Although this relatively radical suggestion was not adopted in the final CBAM legislation, it is possible that organic chemicals and polymers could be included when the CBAM transition period ends in 2026.

04

Why

/ Is Strengthening Carbon Management Important for Enterprises? /

Since the legislative proposal was submitted, there have been many controversies surrounding the EU carbon tariff, such as whether CBAM is a unilateral trade measure, whether it is compatible with WTO rules, and whether it will create new trade barriers. There are also concerns about whether the detailed information required by CBAM, such as production facilities, country of origin, and type of goods, might involve issues of industrial security. Additionally, there are questions about the feasibility of the carbon emission data required by CBAM and the quality of the data.

Despite these controversies, CBAM has been adopted. To better cope with the impact of CBAM, enterprises should proactively strengthen their carbon management for the following reasons:

First, accurately calculating carbon emissions is very important, as it may affect future cost control of products. According to CBAM regulations, authorized declarants must purchase CBAM certificates in advance from the public management platform. The purchase amount is based on the total carbon emissions of imported products, and only one-third of the CBAM certificates can be resold to the European Commission at the original price.

This means that the calculation of total carbon emissions is directly linked to the number of CBAM certificates purchased, and the price of CBAM is tied to the EU-ETS carbon price. Currently, there is no secondary market for CBAM. If the initial purchase of CBAM certificates is significantly higher than the verified embedded emissions of the imported products, it will lead to capital lock-up; if the initial purchase of CBAM certificates is too low, the CBAM price may fluctuate as the "settlement" date approaches.

Currently, the EU-ETS carbon price is approximately 85 euros per ton, while China's carbon allowance price is about 55 yuan per ton. Therefore, relatively accurate carbon emission calculations may also serve as the basis for future cost control of imported products and CBAM certificate procurement decisions.

Second, CBAM includes some indirect emissions, and the scope of products covered may expand after the transition period ends in 2026. The detailed rules for calculating CBAM carbon emissions have not yet been released. Based on the available information, the carbon emissions of simple goods are calculated by allocating Scope 1 and some conditional Scope 2 emissions to each product. Complex goods must also consider the embedded carbon emissions of certain precursors, and the specific boundaries need to be determined.

According to messages from the European Parliament and the Council of the European Union, after the CBAM transition period ends (i.e., by the end of 2025), CBAM may expand to include indirect emissions, downstream value chain emissions, including transportation services. This means that the scope of CBAM will continue to expand towards the coverage of the EU-ETS, so related enterprises in the supply chain can prepare in advance.

Finally, strengthening carbon management and disclosing actual carbon emissions is more beneficial for low-carbon producers. According to CBAM regulations, the embedded carbon emissions of products exported to the EU should be calculated according to the methods specified by CBAM, prioritizing the actual embedded carbon emissions.

If the actual emissions cannot be determined, the average emission intensity of the exporting country can be used with a "multiplier." If reliable data from the exporting country is not applicable to a certain type of product, the default value should be based on the average emission intensity of the X% worst-performing products in the EU carbon market. The "multiplier" and the worst-performing proportion "X" will be determined by the European Commission in the detailed implementation rules.

Therefore, for low-carbon producers, actively registering on the unified CBAM platform and disclosing their verified actual carbon emissions is a more advantageous measure compared to using the default value.

05

Preparing in Advance

/ How Should Enterprises Respond? /

CBAM has set a transition period from October 1, 2023, to December 31, 2025, during which enterprises only need to fulfill reporting obligations without paying any fees. Therefore, exporting producers do not need to be overly anxious and can proactively turn the "transition period" into a "window period" to enhance their carbon management capabilities. So, how should related enterprises respond?

For Chinese exporters of steel, cement, fertilizers, aluminum, and hydrogen-related products, it is essential to quickly establish organizational and product carbon management systems, collect and manage carbon accounting data for organizations and products, set carbon reduction targets and routes, and timely follow the progress of CBAM-related policies to assess the impact of CBAM on the company's future. Related enterprises can actively participate in data collection and reporting during the CBAM transition period to familiarize themselves with the relevant procedures and better adapt to future green trade trends.

For upstream and downstream product exporters in China's steel, cement, fertilizers, aluminum, and hydrogen-related industries, as well as other energy-intensive enterprises, although the probability of being covered by the EU CBAM in the short term is low, the scope may expand after the transition period (end of 2025), and more Scope 3 emissions may be included. Therefore, it is recommended that enterprises in the organic chemicals, polymers, automotive, and machinery industries prepare in advance, strengthen organizational and product-level carbon management, set scientific carbon targets, and be prepared to face future challenges calmly.